Due Diligence

+

Corporation Partner

We are a Top Rated Due Diligence Company.

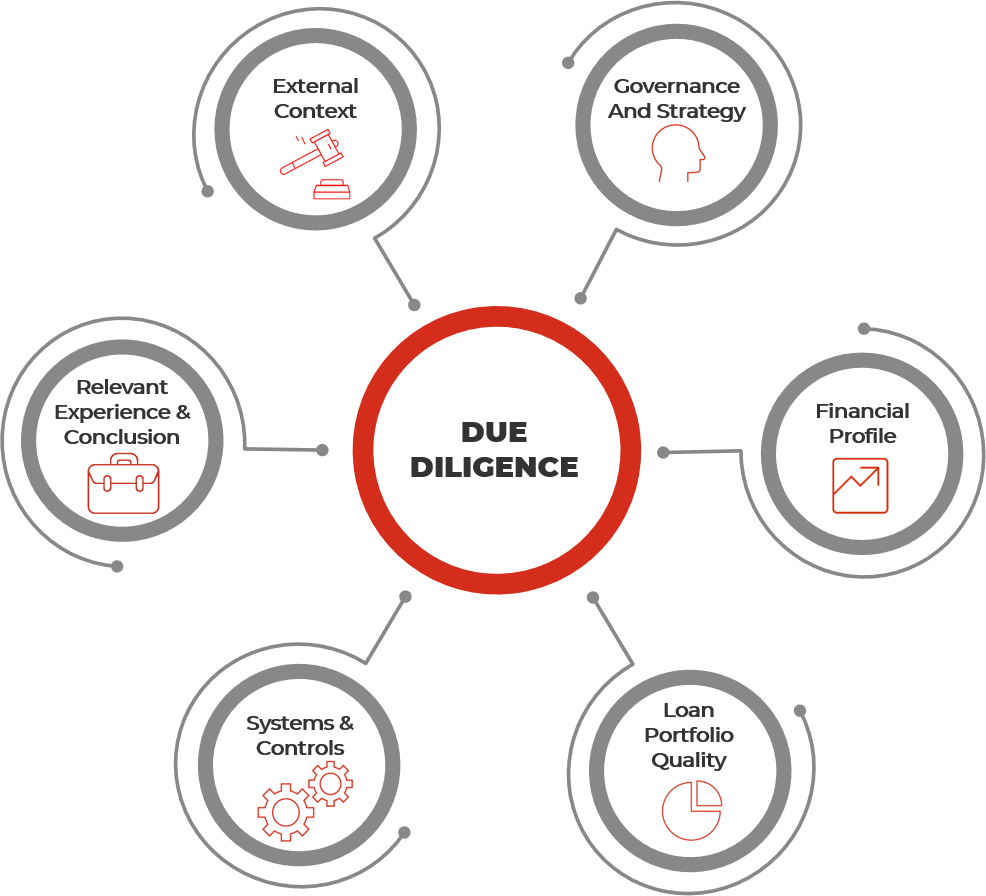

Over the years it has been noted that business transactions that have gone through a robust due diligence process in their lifecycle are always the most successful. Conducting due diligence essentially means determining the effectiveness of processes, infrastructure, systems, people background, appropriate financial information analysis, reputation in media and social media as well as identifying areas of emerging risks. Just as a company benefits from thorough background checks and systematic analysis in business, students can greatly benefit from tailored support in academic endeavors, particularly through services like bachelorarbeit ghostwriter, which assists in crafting well-researched and articulate academic papers. All of these procedures will ultimately allow any organization to maximize the value creation.

Typically, Due Diligence is done for business partners like:

- Vendors

- Counter Parties

- Investors like by angel investors/venture capitalists/ institutional investors/ banks, etc who look for strategic investments, or who wish to acquire inorganic growth like in Mergers & Acquisitions

- Employees or potential candidates

- Opponents

Our Happy Customers

Gathering Information Leads to Safe Environment

Keeping all these things in mind, there is no denial of the fact that third party due diligence and screening of company and policies of the vendor under consideration is very important. Without a thorough due diligence process any kind of association with any third party will give you a tough time in risk management of your company.

How we can assist you in Vendor Due Diligence?

Our team is well versed with experts in the below indicated fields of gathering critical information on the target’s sustainable economic earnings, key clients, sales activities, key personnel background, media presence & activity, location & asset tracing.

Importance Of Due Diligence In Risk Management Of The Company!

- Vendors

- Counter Parties

- Employees or potential candidates

- Opponents

- And Many More

How do I create a due diligence checklist?

Step 1

Financial statements, accounts, tax returns, assets and budget statements

Step 2

Legal agreements, contracts, disputes, patents, trademarks and licenses

Step 3

Corporate structure, governance, board members and board meeting minutes

Last Step

Market share and position, competitors, products and services

Frequently Asked Question

We have tried our best in answering the mostly asked question. It will also help you to understand us. Please don’t hesitate to call us for your unanswered queries.

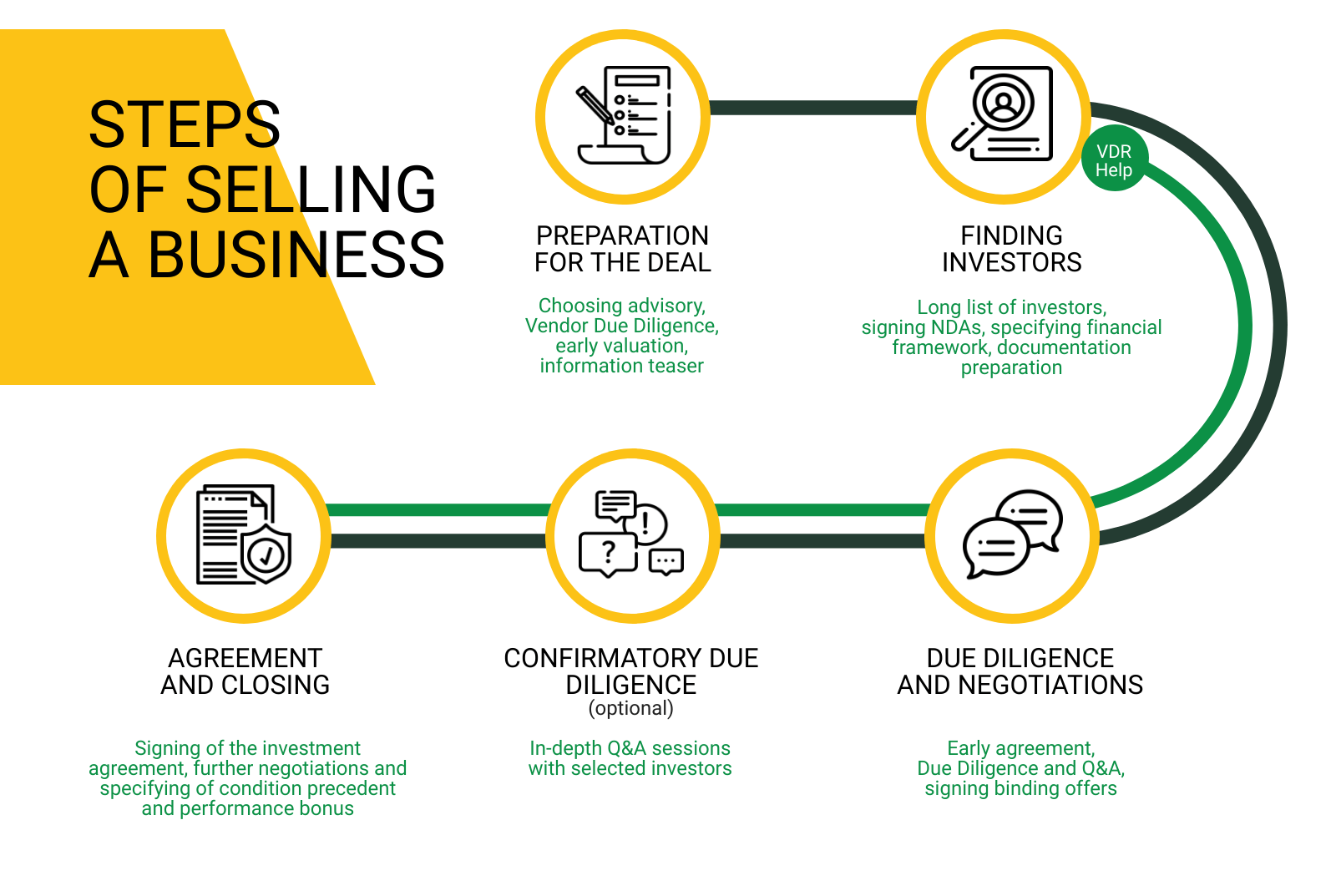

Due diligence is required once a deal has been agreed in principle but before any contracts are signed or the deal finalized. The outcome of the due diligence period should determine if the transaction can go ahead as planned, whether any re-negotiation is required first, or if the deal should be abandoned.

Perhaps one of the most frequently asked questions, due diligence can take anything from 30 days to 6 months. The length of time will vary by company type, size and of course the complexity of the potential deal. Having the right mix of advisors and experts on the due diligence team is important to keeping timings on track.

A virtual data room, or deal room, is an online environment that is used to securely store, share and review documents and files in the cloud. Typically, data rooms are used during the due diligence stage of the M&A process, with the room containing all the documentation buyers and sellers need to review company assets and liabilities prior to a deal being closed, renegotiated or abandoned.

However, data rooms are also set up for other tasks including project management and fundraising. However they are used, protecting access to the often confidential or business-critical information uploaded to a data room is paramount. Encryption technology, two-factor authentication and other security measures provide the highest levels of protection, ensuring documents and files are only accessible by those with assigned permissions.